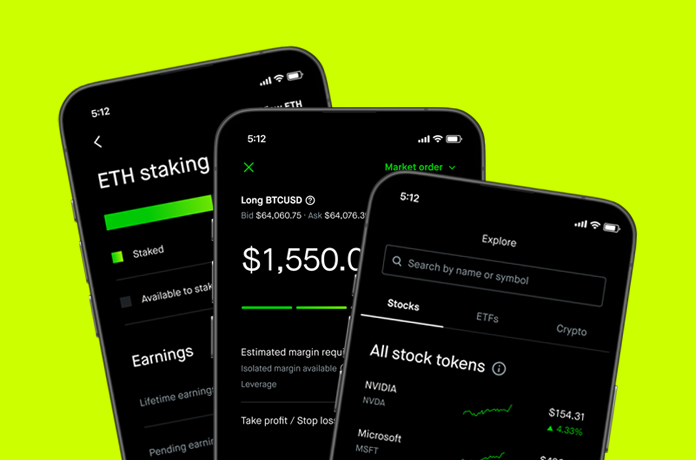

Investment platform Robinhood has announced the launch of US tokenised securities to European customers and the development of its new layer 2 blockchain.

Its new token stocks will bring more than 200 publicly traded US stocks and ETFs on chain to European customers.

“Crypto was built by engineers for engineers, and has not been accessible to most people,” said Johann Kerbrat, GM and SVP of Robinhood Crypto.

“We’re onboarding the world to crypto by making it as easy to use as possible, with the goal of bringing powerful tools into one intuitive platform.”

Initially, Robinhood will be issuing more than 200 tokenised US stocks and ETFs to EU customers directly on Arbitrum One.

However, the company is developing the Robinhood Chain, powered by the Arbitrum Orbit stack.

In its announcement, Robinhood CEO Vlad Tenev, said the move represented a global adoption of crypto and its integration with traditional financial systems.

“Crypto itself – there are two ways to look at it. One, as a tradeable asset…the other a fundamental underlying technology,” he said. “In the second lens, it’s the next stage of evolution. We’ve gone from paper and pencil, filing cabinet-based financial services to mainframe, to on-premise and more recently, cloud.

“In the future, crypto technology will power trading and all sorts of financial services…so the two will fully merge and I think Robinhood will play a big role in that,” said Tenev.

Robinhood has also launched crypto staking for US customers, starting with Ethereum and Solana, following its staking launch in May last year for the EU and EEA.